B1040 2015-2025 free printable template

Show details

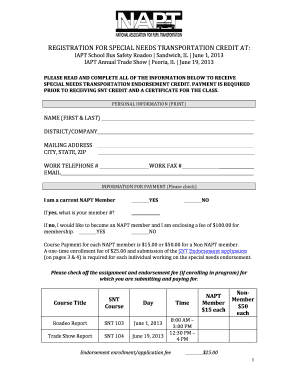

B1040 FORM 1040 12/15 ADVERSARY PROCEEDING NUMBER Instructions on Reverse Court Use Only PLAINTIFFS DEFENDANTS ATTORNEYS Firm Name Address and Telephone No. ATTORNEYS If Known PARTY Check One Box Only Debtor Creditor Trustee U.S. Trustee/Bankruptcy Admin Other CAUSE OF ACTION WRITE A BRIEF STATEMENT OF CAUSE OF ACTION INCLUDING ALL U.S. STATUTES INVOLVED NATURE OF SUIT Number up to five 5 boxes starting with lead cause of action as 1 first alternative cause as 2 second alternative cause as 3...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form b1040

Edit your b1040 1040 instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1040 adversary proceeding form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit b1040 form 1040 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form b1040 fillable. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form b1040 adversary

How to fill out B1040

01

Gather all necessary financial documents, including income statements and details of deductions.

02

Start by filling out your personal information, including your name, address, and Social Security number.

03

Report your total income in the designated section.

04

Fill out the deduction section, including standard or itemized deductions as applicable.

05

Calculate your taxable income by subtracting deductions from total income.

06

Determine your tax liability using the appropriate tax rates, and fill this in the corresponding section.

07

Include any tax credits that apply to your situation.

08

Calculate your total taxes owed or refund due.

09

Sign and date the form before submitting it.

Who needs B1040?

01

Individuals who are U.S. citizens or residents who need to report their income and calculate their taxes owed.

02

Taxpayers who have income from various sources, such as wages, dividends, or business income.

03

Individuals who want to claim deductions or credits on their tax return.

Fill

1040 plaintiffs printable

: Try Risk Free

People Also Ask about b1040 1040 form

What is the simplest 1040 form?

Form 1040-EZ was the shortest of the 1040 forms and the easiest to fill out. It was meant for individuals who only took the standard deduction and didn't itemize.

Does the IRS have a form 1040EZ anymore?

Form 1040EZ is no longer used, but Form 1040 and Form 1040-SR are important for taxpayers to be familiar with. Here's a guide to what is on these forms and what has changed from previous tax years.

Is there a 1040 easy form?

The simplest IRS form is the Form 1040EZ.

What is line 12b on a 1040?

Charitable Contributions (if Standard Deduction Taken)

What is line 16 on the 1040?

Line 16 is a manual entry of tax in the far right-hand column. Review the Form 1040 instructions for the three checkboxes. Do not check any of the boxes or enter any information associated with these checkboxes unless you are instructed to do so.

How to fill out 1040 line 12a?

0:21 5:01 How to Fill out 2021 Form 1040 Income Tax Return for a - YouTube YouTube Start of suggested clip End of suggested clip And down to line 11 as you have no adjustments to income. On line 12a put your standard deduction.MoreAnd down to line 11 as you have no adjustments to income. On line 12a put your standard deduction. Since you can be claimed as a dependent on someone else's.

What are the instructions for line 12a on 1040 SR?

First, 12a asks you to write in either the amount of your standard deduction or your itemized deductions. Most people will take the standard deduction, which is listed on the form to the left of this line (your standard deduction is higher if you're over age 65 or blind).

What is line 12a on the 1040?

A taxpayer's standard or total itemized deductions are listed on line 12a of the Form 1040. The individual components of the itemized deduction are listed on lines 1 to 16 on Schedule A to Form 1040 in Appendix A. The 199A deduction for qualified business income, if applicable, is listed on line 13 of the Form 1040.

Does the IRS provide fillable forms?

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Choose the income tax form you need. Enter your tax information online.

Does the IRS have fillable PDF forms?

Yes. You can use Free File Fillable Forms to e-file your federal return. This means you are filing your return electronically over the Internet.

How do I fill out 1040 by hand?

0:56 11:47 How to Fill Out Form 1040 for 2022 | Taxes 2023 | Money Instructor YouTube Start of suggested clip End of suggested clip The form 1040 can also help you determine whether tax credits or withholding taxes covered your tax.MoreThe form 1040 can also help you determine whether tax credits or withholding taxes covered your tax. Bill.

How do I create an IRS fillable PDF form?

Visit the Free File Site. Select "Free File Fillable Forms Now” and then hit “Leave IRS Site” after reading the disclaimer. Start the Process. Select “Start Free File Fillable Forms” and hit “Continue.” Get Registered. Select Your 1040. Fill Out Your Tax Forms. E-File Your Tax Form. CREATE AN ACCOUNT. Complete Your Account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 1040 adversary print in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your 1040 adversary printable and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send b1040 form address to be eSigned by others?

1040 plaintiffs address is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit 1040 defendants address online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your form 1040 reverse to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is B1040?

B1040 is a tax form used in the United States for individual income tax reporting. It is the standard form used by U.S. taxpayers to file their personal income tax returns with the Internal Revenue Service (IRS).

Who is required to file B1040?

Individuals who earn income above a certain threshold, owe taxes, or wish to claim tax credits or refunds are required to file Form B1040. This includes employees, self-employed individuals, and those receiving various types of income.

How to fill out B1040?

To fill out B1040, taxpayers must gather their financial documents including W-2s, 1099s, and records of deductions and credits. They complete the form by entering their personal information, reporting income, calculating adjustments, claiming deductions/credits, and determining the tax owed or refund due.

What is the purpose of B1040?

The purpose of B1040 is to report an individual's annual income, calculate taxes owed, and determine if the taxpayer is eligible for tax credits or deductions, ultimately to facilitate the assessment and collection of federal income taxes.

What information must be reported on B1040?

Information that must be reported on B1040 includes personal details (name, address, Social Security number), income sources ( wages, interest, dividends), adjustments to income, standard or itemized deductions, tax credits, and any additional taxes owed or refunds due.

Fill out your B1040 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Defendant Defendants is not the form you're looking for?Search for another form here.

Keywords relevant to 1040 b1040

Related to 1040 forms printable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.